Check Out Our Blue Collection

A professional, clean, and timeless graphic aesthetic in a sleek corporate blue colourway.

New content drops every month

Easily download your favourite posts

01

Clicking the image to download

02

Right-click the image and select ‘save image’

03

Upload your download to social media and start posting!

Looking to edit these templates?

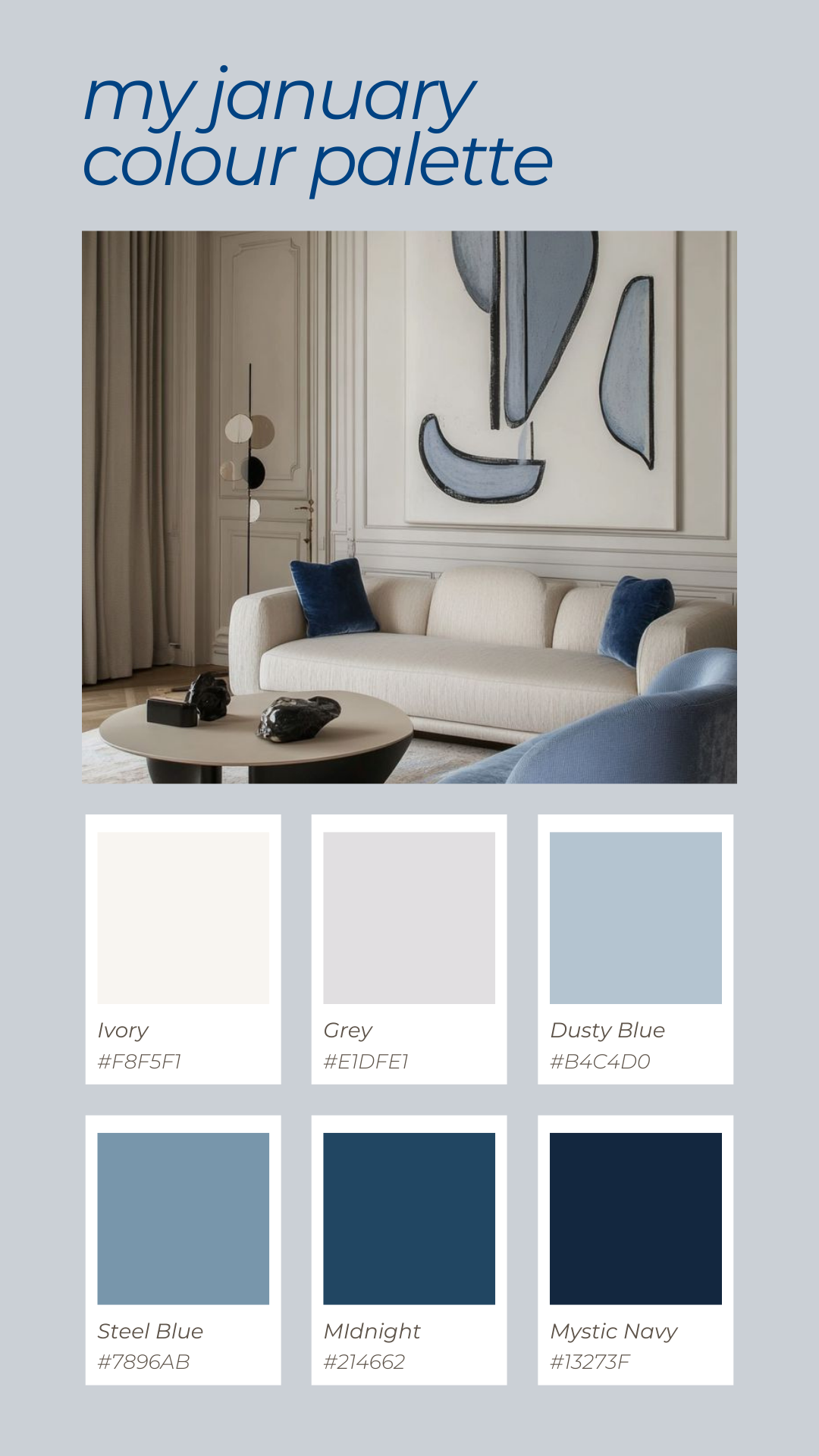

Welcome January! A new year means new opportunities to get clear, get organized, and build the financial future you’ve been working toward. Whether you’re planning to buy, refinance, or renew, I’m here to help you start 2026 with confidence and clarity. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Hello January! A fresh month and a clean slate to revisit your homeownership goals and update your mortgage strategy. Let’s make smart, intentional moves this year to strengthen your financial foundation. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Welcome to a brand new year! January is the perfect time to reassess your mortgage, refresh your financial goals, and map out your path to homeownership or stronger equity. Let’s make 2026 your most empowered year yet. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Buying early in the year isn’t just about timing—it’s about giving yourself the breathing room to customize, renovate, and settle comfortably into your new space. With fewer market pressures and more time to plan, you can start the year building a home that truly reflects you. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Sometimes the most important progress comes from the smallest steps. Whether you’re dreaming of a new home, planning your next move, or simply resetting for the year ahead, taking that first step is what creates real momentum. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Achieving your goals isn’t just about the end result—it’s about who you become along the way. Whether you’re working toward homeownership, rebuilding your finances, or planning your next mortgage move, every step forward shapes a stronger, more confident version of you. Keep going—you’re building something bigger than you think. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #MindsetMatters #FirstTimeBuyer #CanadianBuy

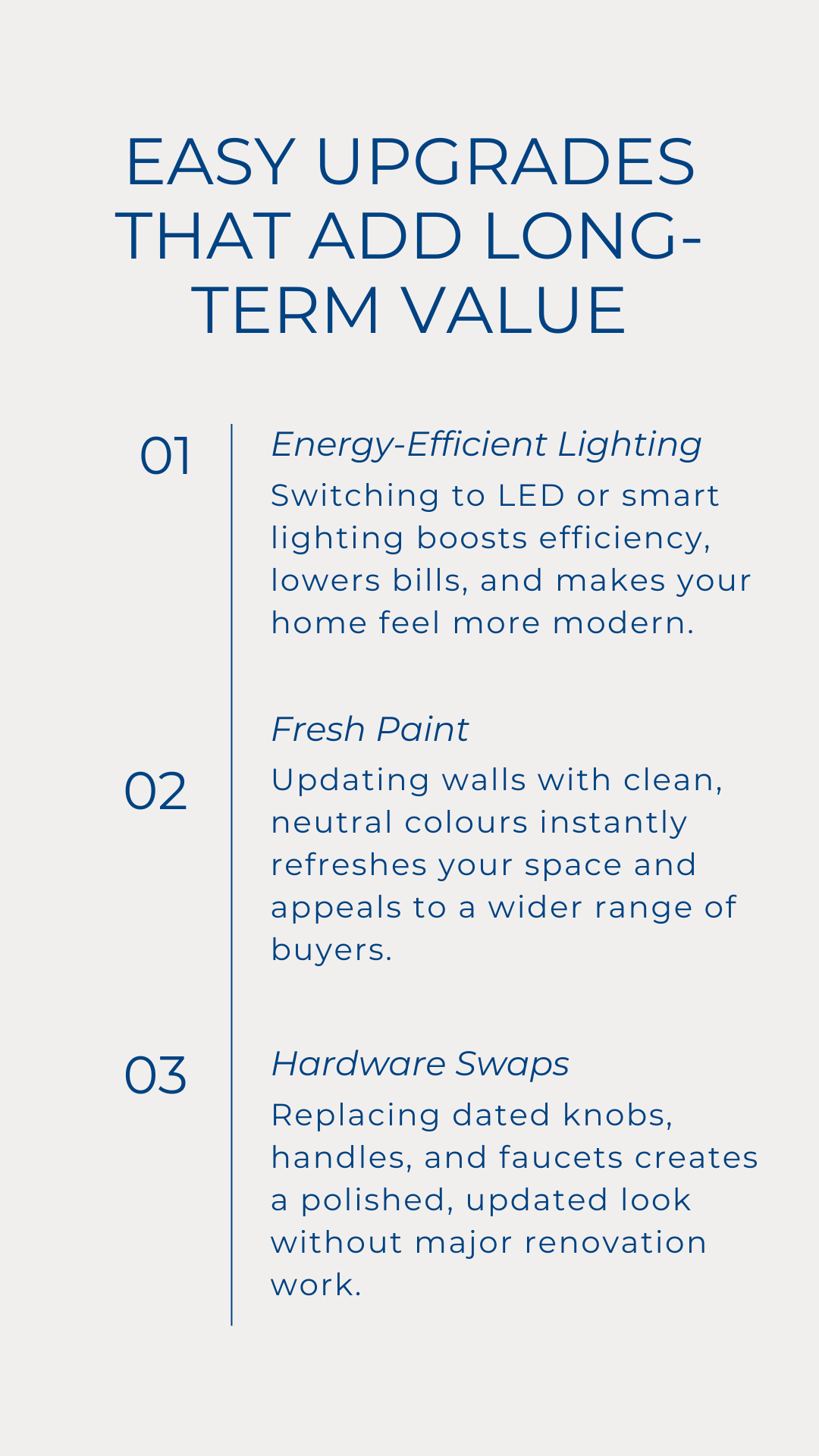

January appraisals can impact your refinance value, especially with winter slowing the market. Taking time to prepare your home can help boost your results. A little planning now can make a big difference in the numbers you get back. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Three months before buying your first home is the perfect time to get organized. From reviewing your finances to securing pre-approval and exploring neighbourhoods, these early steps set the foundation for a confident and stress-free homebuying experience. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Energy efficiency does more than cut monthly bills—it makes your home more comfortable, sustainable, and attractive to today’s buyers. From upgraded windows to smart thermostats, these features add real value and long-lasting appeal. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

The holiday season can bring financial pressure for families—and reverse equity can offer support without adding monthly payments. If you’re considering helping your adult children get back on track, using your home’s equity wisely can create breathing room for everyone. Let’s explore if this option fits your goals. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #RetirementPlanning #ReverseMortgage

Your Stability Score plays a bigger role in mortgage approval than most people realize. It reflects how consistently you manage your income, debts, and payments—giving lenders confidence in your long-term reliability. Strengthen the habits behind your score, and you strengthen your overall mortgage profile. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

January is the perfect month to map out your mortgage and financial goals for the year ahead. A clear plan now can make every decision easier—and more strategic. Let’s build a roadmap that aligns with your 2026 vision. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

A new year brings new opportunities—and your next chapter starts with the home that supports your goals, routines, and lifestyle. Whether you’re ready to buy, sell, or simply explore your options, now is the perfect time to take that first step forward. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

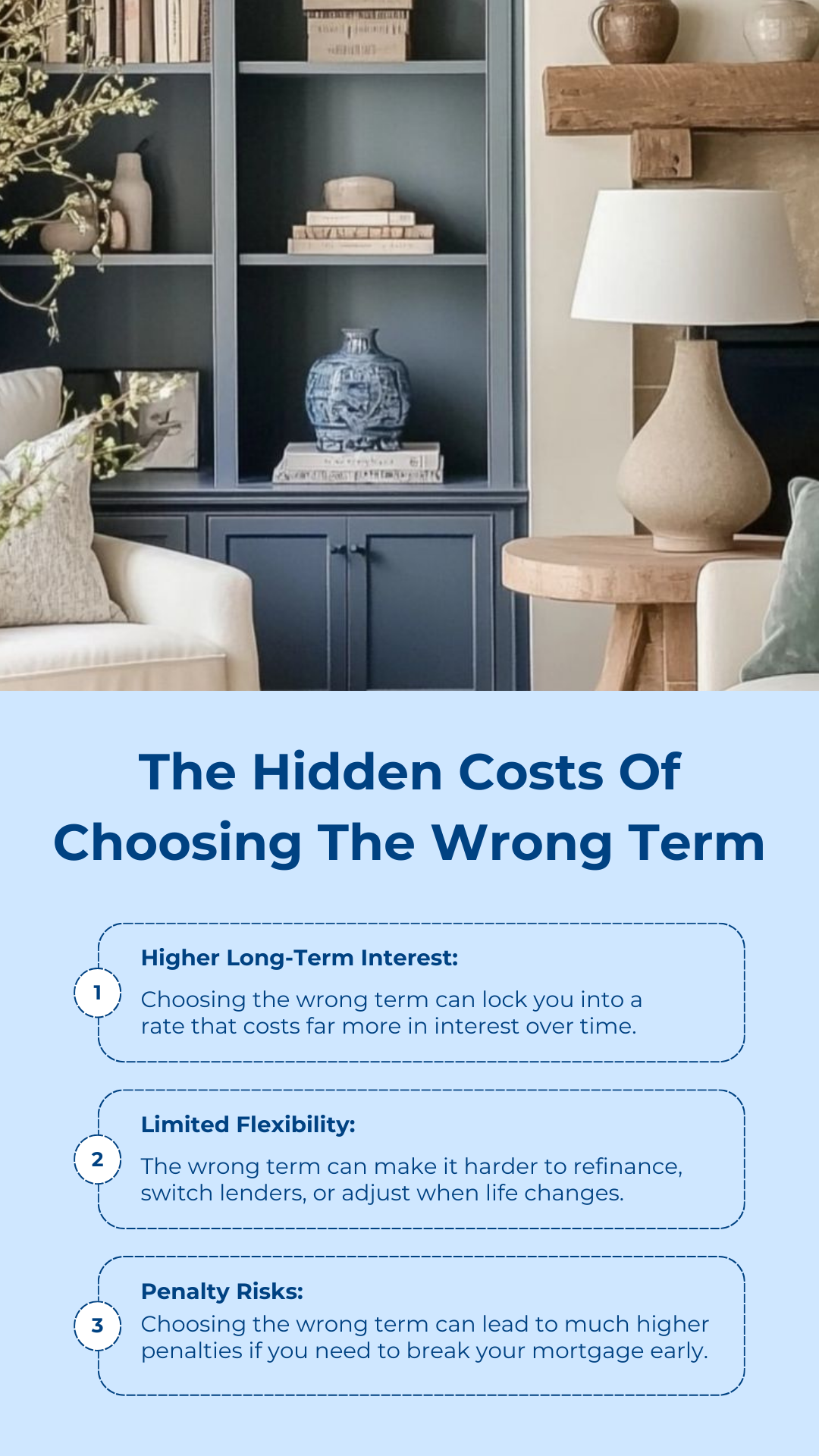

The right mortgage plan starts with understanding your goals, your finances, and the options that fit you best. Whether you’re buying, refinancing, or renewing, I’ll help you choose a strategy that sets you up for long-term success. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Q1 sets the tone for your entire investment year. Reviewing cash flow, renewing leases, and tightening your financing strategy now can position your portfolio for stronger returns all year long. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

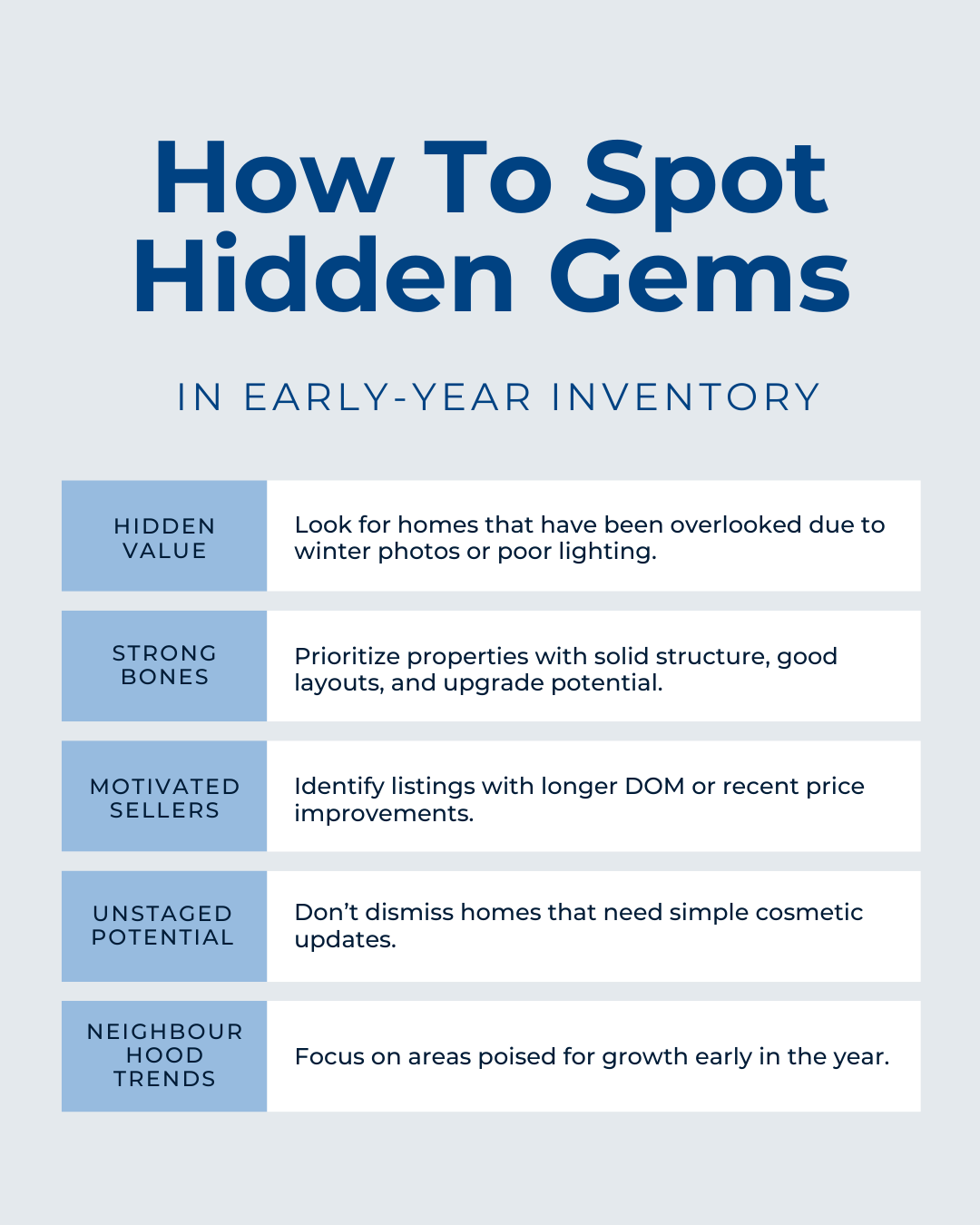

Early-year inventory often holds hidden gems—homes with strong potential that many buyers skip over too quickly. By looking past winter lighting, outdated décor, or minor flaws, you can find properties with great value, motivated sellers, and long-term upside. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

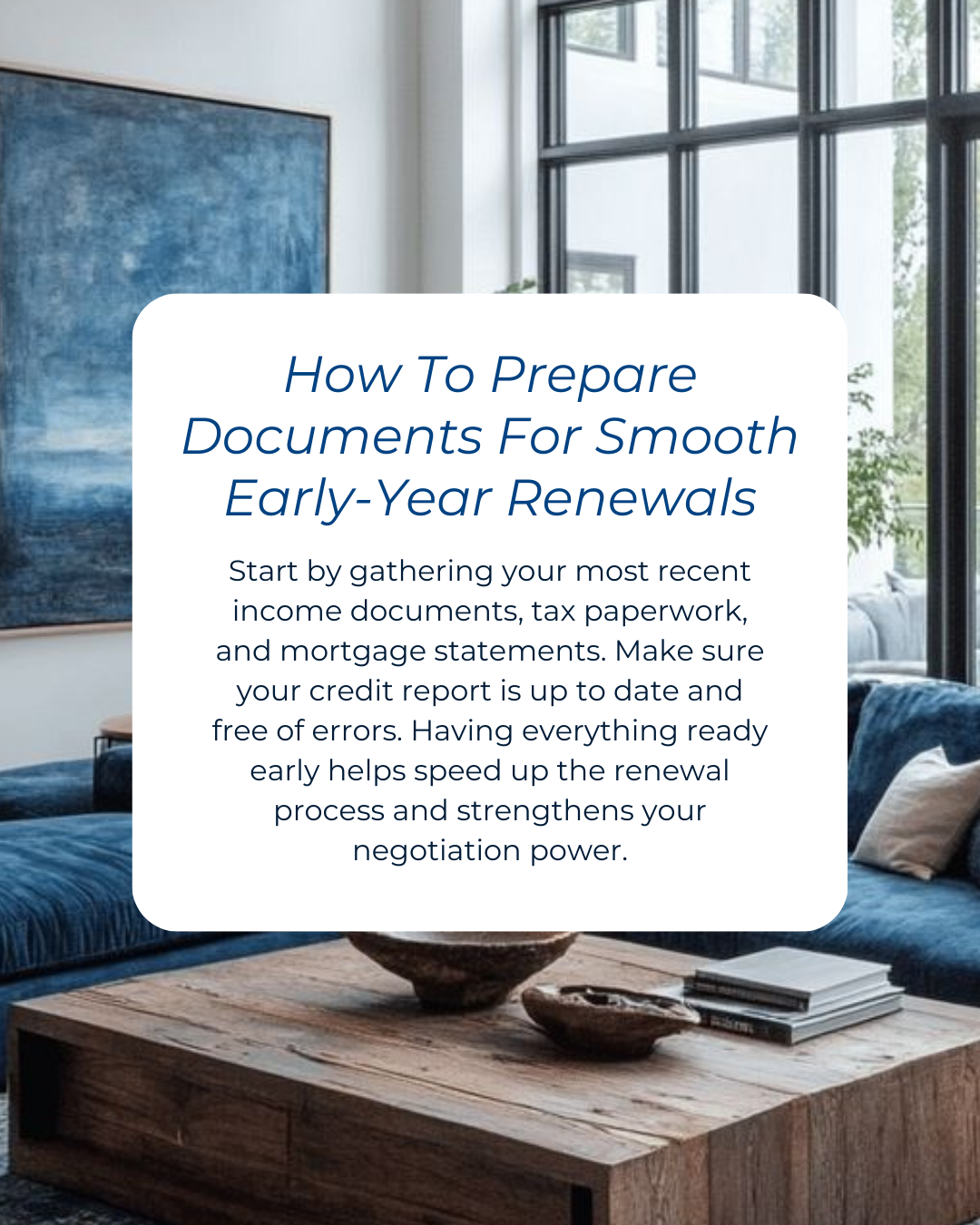

Renewals run smoother when your documents are organized early in the year. A little prep now can save time, reduce stress, and help you secure better terms. Let’s make your renewal as easy—and strategic—as possible. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

A fresh year starts with a fresh space. Clearing out holiday clutter and resetting your home brings instant calm, helps you stay organized, and sets the tone for a lighter, more intentional season ahead. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

A realistic home maintenance budget is the key to stress-free homeownership. By setting money aside for both small fixes and long-term upgrades, you’ll keep your home in great shape and protect its value throughout 2026. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Cold weather makes it easier to spot where your home is losing heat—and that’s why January is the perfect time for a home energy audit. Identifying problem areas now helps you boost comfort, reduce heating costs, and start the year with a more efficient home. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

A home should grow with you. By designing flexible spaces, choosing timeless finishes, and planning for future needs, you create a home that adapts beautifully to every season of your life. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Your home equity is one of your biggest financial tools—so check in on it every year. A quick review can reveal opportunities to refinance, invest, or simply strengthen your long-term financial strategy. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Spring buyers win when they start in January. Getting your finances organized and securing a strong pre-approval now puts you ahead of the competition long before the market picks up. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Small debt coverage moves can make a big impact on your borrowing power. Focus on lowering balances, avoiding new credit, and keeping income stable to strengthen your next approval. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

You can speed up your U.S. pre-approval by organizing your documents early and working with someone who understands cross-border lending. With the right strategy, buying in the U.S. from Canada becomes a smooth, stress-free process. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

U.S. mortgages don’t have to feel confusing—especially when you have the right guidance. I’ll walk you through every step so you can buy or invest in the U.S. with total confidence and zero guesswork. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

New content drops every month

Easily download your favourite stories

01

Clicking the image to download

02

Right-click the image and select ‘save image’

03