OH Light Collection

A soft, cozy, neutral, graphic aesthetic in a warm beige and tan colourway.

Download any post you like by:

1

Clicking the image to download.

2

Right-click the image and

select ‘save image’

3

Upload your download to social media and start posting!

Looking to edit these templates?

Hello March! A new month brings fresh opportunities for homeowners and buyers. Whether you’re ready to make a move, refinance, or secure the best rate, I’m here to guide you every step of the way. Let’s make this month a step closer to your homeownership goals! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Hello March! Cheers to new opportunities in homeownership! Whether you’re looking to buy, refinance, or explore your mortgage options, I’m here to help make it happen. Let’s kick off this month with the next step toward your homeownership dreams! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Hello March! A new month means new opportunities in the mortgage world. Whether you're buying, refinancing, or exploring your options, I’m here to help you take the next step toward your homeownership goals. Let’s make it happen this month! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Choosing the right neighborhood is key to finding the perfect home. From lifestyle to future growth potential, it’s important to pick a location that suits your needs. Let’s work together to ensure you’re in the ideal spot for your next move! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Your credit report plays a crucial role in mortgage approval. Keeping an eye on it can help ensure you're ready for your next home purchase. Let’s work together to stay on track and secure the home you’ve been dreaming of! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Inflation can have a big impact on mortgage rates, making it important to stay informed. By understanding how inflation affects rates, you can make smarter decisions for your financial future. Let’s work together to navigate these changes and keep your homeownership goals on track! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

A co-signer can help boost your chances of mortgage approval, even if your credit isn’t where it needs to be. With the right support, you can secure the home of your dreams. Let’s work together to explore how a co-signer can help you navigate the path to homeownership! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

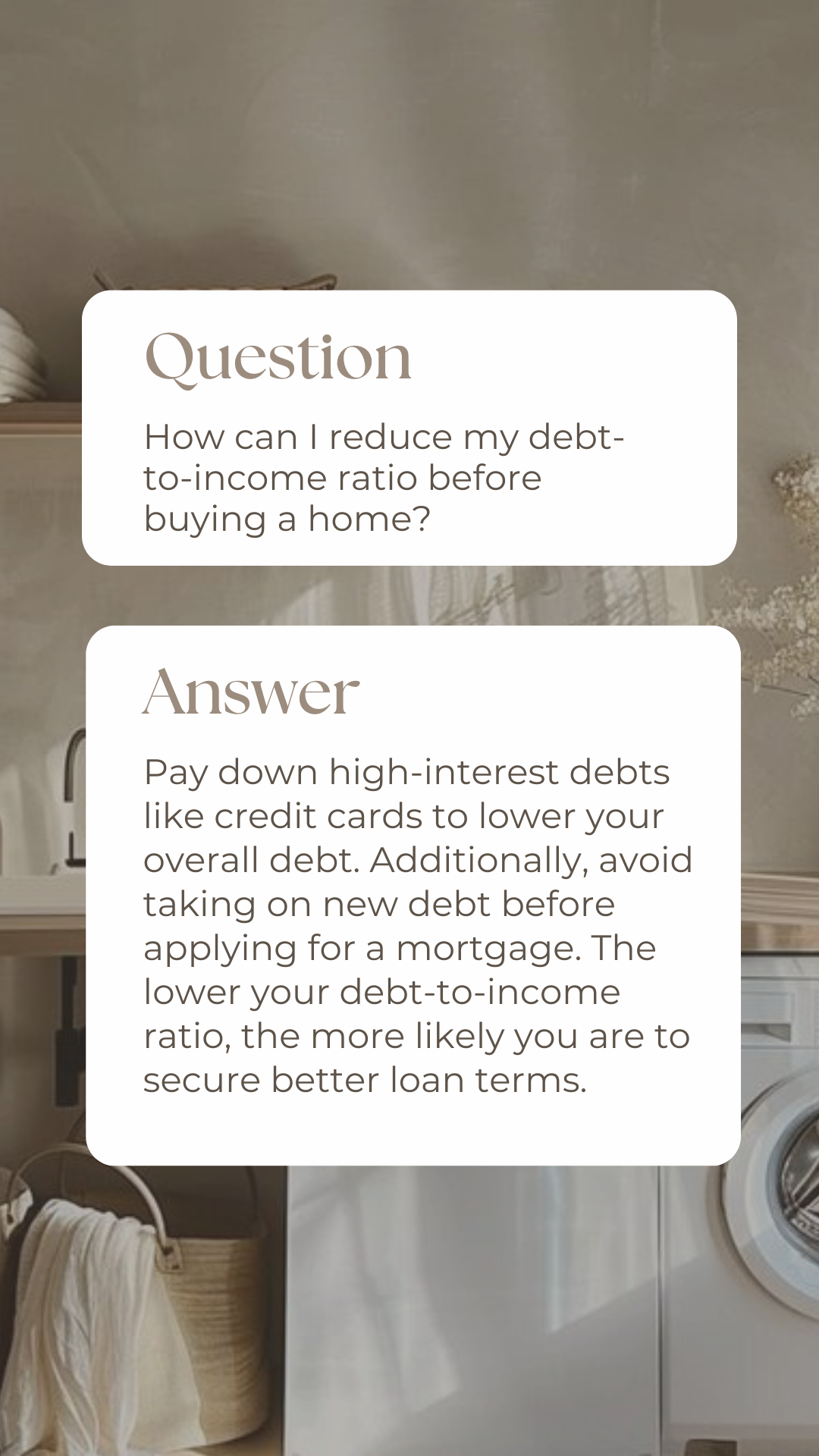

High credit card debt can definitely impact your mortgage approval, but with the right strategies, you can still work toward your homeownership goals. From improving your credit score to managing debt, I’m here to help you navigate the process and set you up for success. Let’s tackle your financial hurdles together and make homeownership a reality! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Spring is here, and with it comes a shift in the market! The increase in demand and competition can affect house prices, and I’m here to help you navigate these changes. Let’s work together to make sure you get the best value for your home this season! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

An assumed mortgage allows you to take over the current mortgage of a seller, making it a great option for buyers in certain situations. This can be a smart move if the current mortgage terms are favorable. If you're considering assuming a mortgage, I’m here to guide you through the process and help you determine if it’s the right choice for you! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

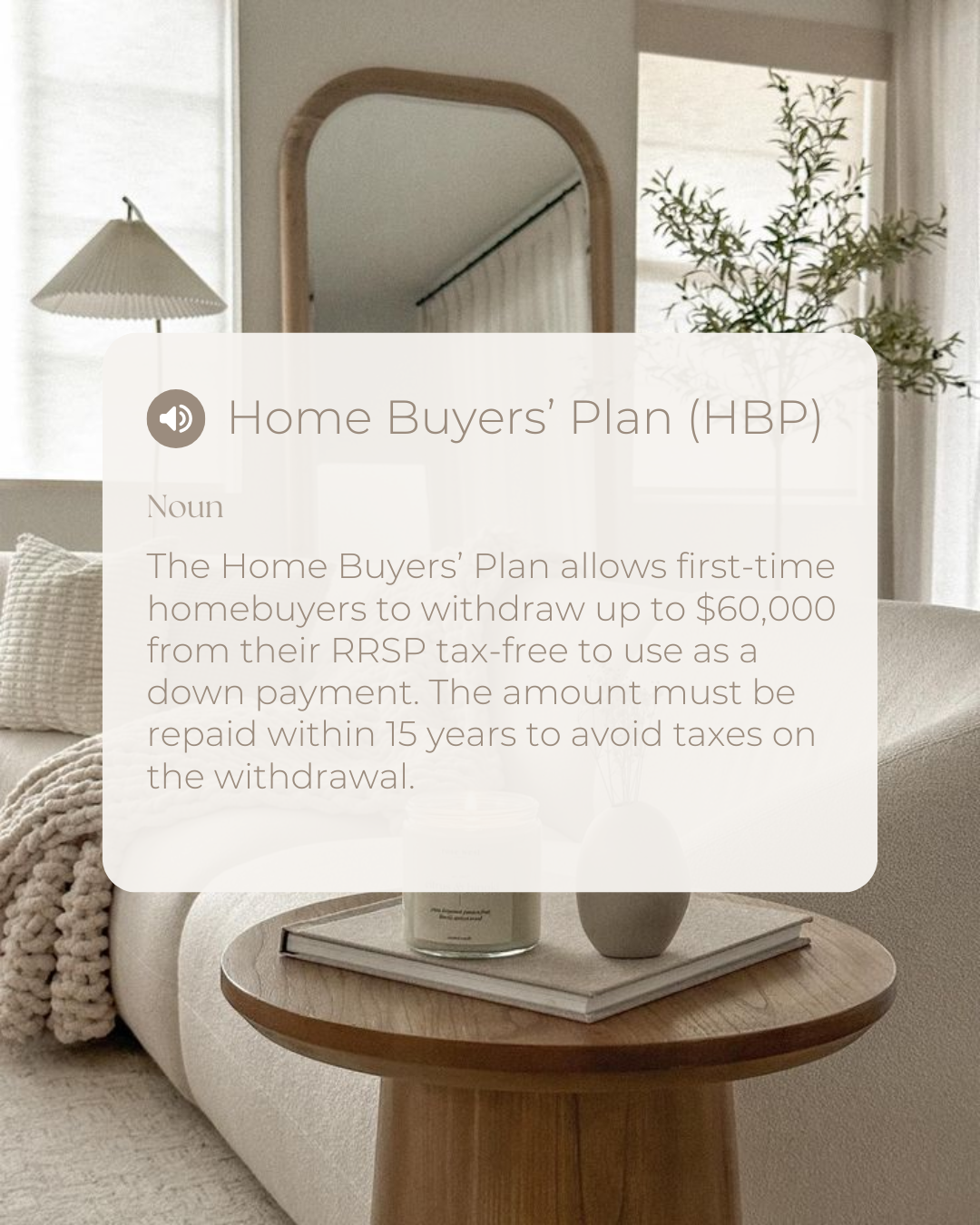

The Home Buyers’ Plan allows you to use your RRSP savings for a down payment, making homeownership more accessible. This program can be a great way to jumpstart your home buying journey. If you’re thinking about using the Home Buyers' Plan, I’m here to help guide you through the process and make sure you’re taking full advantage of this valuable opportunity! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

The road to homeownership is always under construction, but every step you take brings you closer to your dream home. Whether you’re applying for a mortgage, refinancing, or navigating the process, steady progress and expert guidance will lead you to success. Let’s build your path to homeownership together—one step at a time! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Your forever home is waiting! Whether you're ready to buy your dream home, refinance, or explore new mortgage options, I’m here to help you every step of the way. Let’s find the perfect home for you and make your homeownership journey a success! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

In 2025, the Canadian government has made it easier for first-time homebuyers to enter the market by increasing the cap on insured mortgages from C$1 million to C$1.5 million. This means you can now purchase a home with just a 5% down payment, opening up more opportunities for homeownership. Let’s explore how these changes can work in your favor and help you secure the home of your dreams! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Understanding property taxes is essential to making informed decisions as a homeowner. Knowing how they impact your monthly payments and overall budget can help you plan for the future. Let’s work together to ensure you fully understand your property tax obligations and how they affect your homeownership journey! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Your home equity can be a powerful tool for future investments! By leveraging it, you can fund renovations, invest in real estate, or even expand your investment portfolio. Let’s explore how you can unlock the potential in your home and make it work for your financial goals! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Homeownership comes with more than just your mortgage payment! From property taxes and maintenance to utilities and unexpected repairs, it’s important to plan for these hidden costs. Let’s work together to ensure you’re financially prepared for all aspects of homeownership and set you up for success! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Ready to find your dream home? This spring is the perfect time to start your search! Let’s get you pre-approved and on the path to discovering the perfect home that fits your needs. I’m here to make the process easy and stress-free – let’s get started! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Ready to stop renting and start owning? Your dream home is within reach, and I’m here to help you make it happen! Let’s explore your mortgage options and find the best path to homeownership, setting you up for a bright financial future! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

New season, new home! Whether you're buying your first home or looking for a fresh start, I’m here to help make your dream a reality. Reach out today, and let's work together to find the perfect mortgage that fits your needs for a smooth and successful homebuying journey! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

If you’re feeling like your current mortgage isn’t working for you, refinancing could be the solution to save money and lower your payments. Let’s explore your options and find the best fit for your financial goals! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Unlock the potential in your home and use it to achieve your financial goals. Let’s work together to create a smart plan and help you leverage your home’s value for a more secure future! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Refinancing costs are an important part of the process to consider before making a move. These costs can include appraisal fees, legal fees, and closing costs, but the long-term benefits may outweigh the initial expenses. Let’s discuss your options and ensure you fully understand the refinancing process to make the best decision for your financial future! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Navigating the mortgage process as a self-employed individual can be tricky, but with the right preparation, it’s totally possible! Start by organizing your financial records, showing consistent income, and building a solid credit history. Let’s work together to find the best mortgage options for you and make your homeownership dreams a reality! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Managing your mortgage payments effectively is the key to financial peace of mind. By staying organized and making timely payments, you can avoid stress and build equity faster. Let’s work together to ensure your mortgage plan aligns with your financial goals and sets you up for long-term success! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Thinking about spring renovations? Start by planning early—create a budget, set realistic goals, and research materials. Whether it's updating your kitchen or adding curb appeal, I’m here to help you plan a smooth renovation process and make your home even more enjoyable this season! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Ready for mortgage pre-approval in a competitive market? Start by organizing your financial documents, checking your credit score, and saving for a down payment. I’ll help you navigate the process and ensure you're in the best position to secure your dream home in this fast-moving market! Let’s get you pre-approved with confidence! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

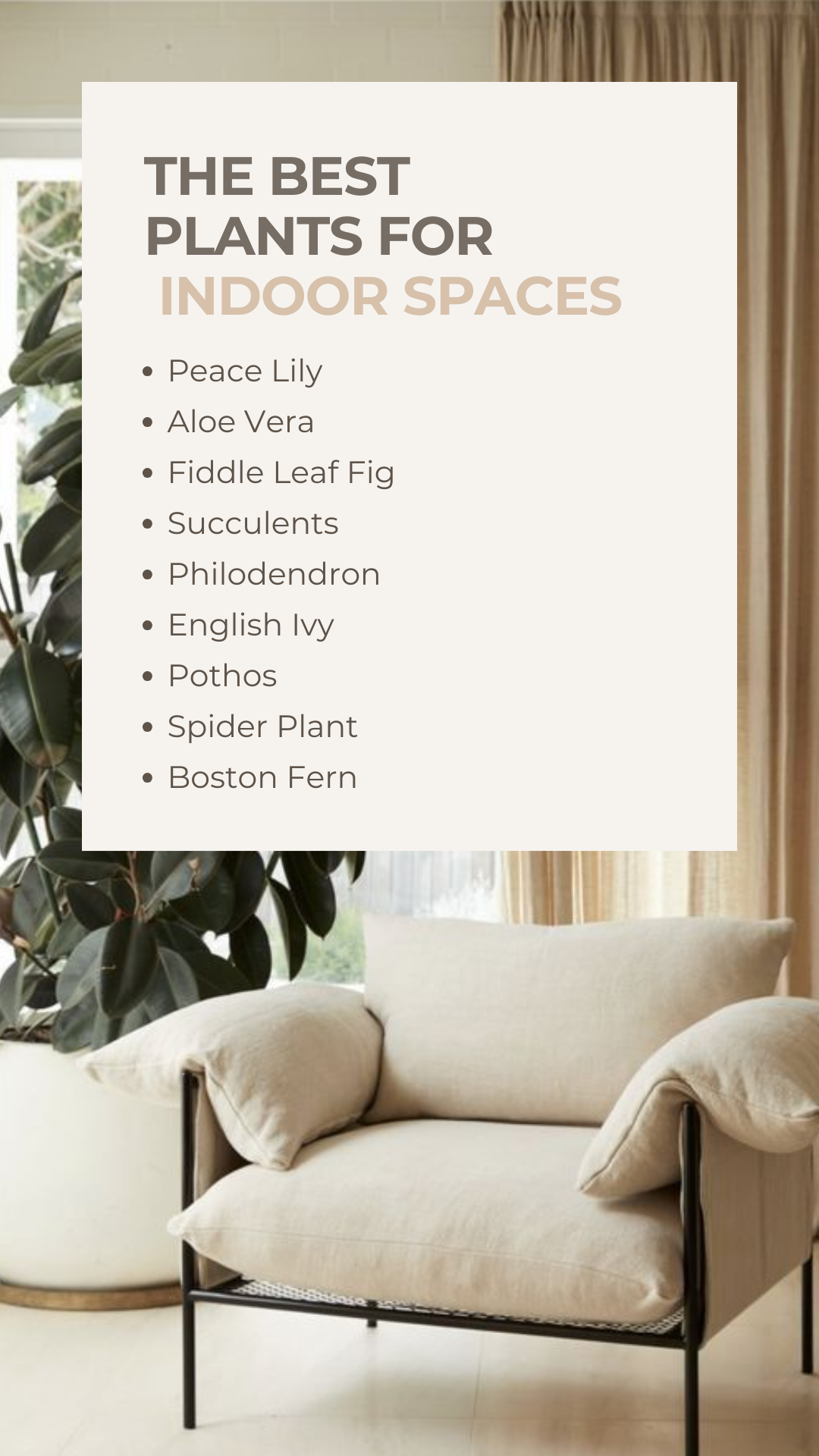

Spring is the perfect time to refresh your home! Start by decluttering, deep cleaning, and adding fresh touches like new plants or a coat of paint. Whether you’re updating your decor or planning a bigger renovation, I’m here to guide you through the process and help you finance those updates to keep your home beautiful and valuable for years to come! Let’s make this spring your home’s best season yet! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Decluttering and organizing your home not only boosts your space but also enhances your peace of mind! A tidy home can improve productivity and make it easier to plan for future updates—whether you’re renovating or refinancing. Let’s work together to create a space that works for you and supports your homeownership goals! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Preparing for a home appraisal is key to getting the best value for your property! Swipe to learn the steps you can take to ensure your home shines and stands out during the appraisal process. Small improvements and a little preparation can make all the difference. Let’s work together to make sure you're set up for a successful homeownership journey! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Download any story you like by:

1

Clicking the image to download.

2

Right-click the image and

select ‘save image’

3

Upload your download to social media and start posting!

Looking to edit these templates?