Check Out Our Pink Collection

A soft, cozy, neutral, graphic aesthetic in a warm beige and tan colourway.

New content drops every month

Easily download your favourite posts

01

Clicking the image to download

02

Right-click the image and select ‘save image’

03

Upload your download to social media and start posting!

Looking to edit these templates?

Hello August! The summer sun is shining bright, and so are your opportunities to move closer to your homeownership dreams. Whether it’s securing the right mortgage, refinancing, or boosting your credit, I’m here to guide you every step of the way. Let’s make this month the start of something great! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Hello August! It’s a fresh new month full of chances to get closer to your home goals. Whether you’re buying, refinancing, or improving your credit, I’m here to help you make smart moves with confidence. Let’s work together to make this your best month yet! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Hello August! Summer’s in full swing, and it’s the perfect time to turn up the heat on your homeownership goals. Whether you’re ready to buy, refinance, or need expert mortgage guidance, I’m here to help you take that next confident step. Let’s make this season one to remember for your financial future! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Summer’s heat won’t stop your home search! Stay cool and focused, and I’ll help you find the perfect place this season. Ready when you are! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Your credit score has a big impact on the refinance rates and terms you qualify for—so don’t overlook it! Even a small boost can lead to significant savings and better options. Check in on your score before you apply, and let’s work together to get you the best deal possible. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Changing jobs can impact your mortgage application, but it doesn’t have to derail your plans. Lenders look at job stability, income consistency, and your overall financial picture to make their decisions. Let’s discuss your situation and find the best approach to keep your mortgage journey on track! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

It’s a good idea to review and update your home budget every few months or whenever you experience major changes like renovations or utility bill spikes. Staying on top of your budget helps you manage expenses and avoid surprises down the road. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Think seasonal income disqualifies you from getting a second mortgage? That’s not true! Many lenders consider your full financial picture, including seasonal earnings, to find the best solution for you. Let’s explore how a second mortgage can still fit your unique income situation and support your goals. #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Deciding whether to pay off credit cards or your mortgage first depends on your financial priorities and goals. Paying off high-interest credit cards can save you money and improve your credit score, while tackling your mortgage early builds home equity and reduces long-term debt. Let’s review your situation together to create a plan that balances both and sets you up for success! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Equity take-out lets you access the cash tied up in your home by refinancing your mortgage. Whether you’re planning renovations, consolidating debt, or investing in new opportunities, tapping into your home equity can give you the financial flexibility you need. Let’s explore how an equity take-out could work for you and support your goals! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

A Lock-In Period is the set time during which you agree to keep your mortgage with the lender at a fixed rate, even if interest rates change. It provides rate security but may include penalties if you break the agreement early. Let’s discuss how a lock-in period can protect your finances and fit your homeownership plans! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

August is the perfect time to tackle home maintenance before fall arrives. From checking your HVAC to sealing windows, these small tasks can save you time and money down the road. Let’s make sure your home stays in top shape all year long! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Celebrate summer’s end by creating the perfect outdoor dinner setup! Think cozy lighting, comfortable seating, and seasonal touches that make every meal feel special. Let’s help you find a space where memories—and great conversations—can flourish as the season winds down. #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Looking for ways to cover retirement living costs without dipping into your savings? A reverse mortgage can provide you with tax-free cash flow by tapping into your home’s equity—helping you maintain your lifestyle comfortably. Let’s explore if this option fits your retirement goals and create a plan tailored just for you! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Summer’s winding down, but the market is still hot! If you’re ready to buy or sell before the season ends, now’s the time to act. Let’s make the most of these final summer weeks together! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

It’s the perfect time to review your mortgage and make sure it still aligns with your goals. Whether you’re thinking about refinancing, paying down debt, or planning your next move, I’m here to help you make confident decisions that keep your financial future on track. Let’s connect and keep your mortgage working for you! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

August is for fresh starts and new opportunities! Whether you’re ready to buy your first home, refinance for better terms, or explore investment possibilities, I’m here to support you every step of the way. Let’s boost your cash flow with smart refinance solutions and make this month the beginning of your next great chapter! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Your finances, your future—let’s build a plan that fits both perfectly! Whether you’re buying, refinancing, or consolidating debt, I’m here to help you create a strategy that supports your goals and gives you peace of mind. Together, we’ll make sure your financial future is strong and secure. Let’s get started today! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Let’s turn your home goals into milestones you can celebrate! Whether you’re stepping into homeownership or refinancing for a better future, I’m here to guide you every step of the way. Together, we’ll create a plan that brings your dreams closer, one milestone at a time. Let’s start building your path to success today! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Property tax season is coming—are you ready? Knowing your payment deadlines and understanding how your property is assessed can help you plan your budget with confidence. I’m here to guide you through what to expect and how to stay on top of your property taxes without stress. Let’s make sure you’re prepared and in control this season! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Thinking of buying a home late in the season? Staying flexible and ready to act fast can open the door to great opportunities. Motivated sellers often want to close before year-end, so keeping close with your realtor can help you navigate competition and secure the best deal. Let’s work together to make your homeownership goals a reality—no matter the season! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Progress is progress—no matter the pace. When it comes to your home and financial goals, every step forward counts. Whether you’re saving for a down payment, improving your credit, or planning your next move, I’m here to support you through the journey. Let’s keep moving forward together! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Positive change starts with a decision—and that includes your home and financial future. Whether you’re ready to buy, refinance, or invest, making intentional moves today can create the better tomorrow you deserve. I’m here to guide you through every step of the process. Let’s embrace change and build your success together! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

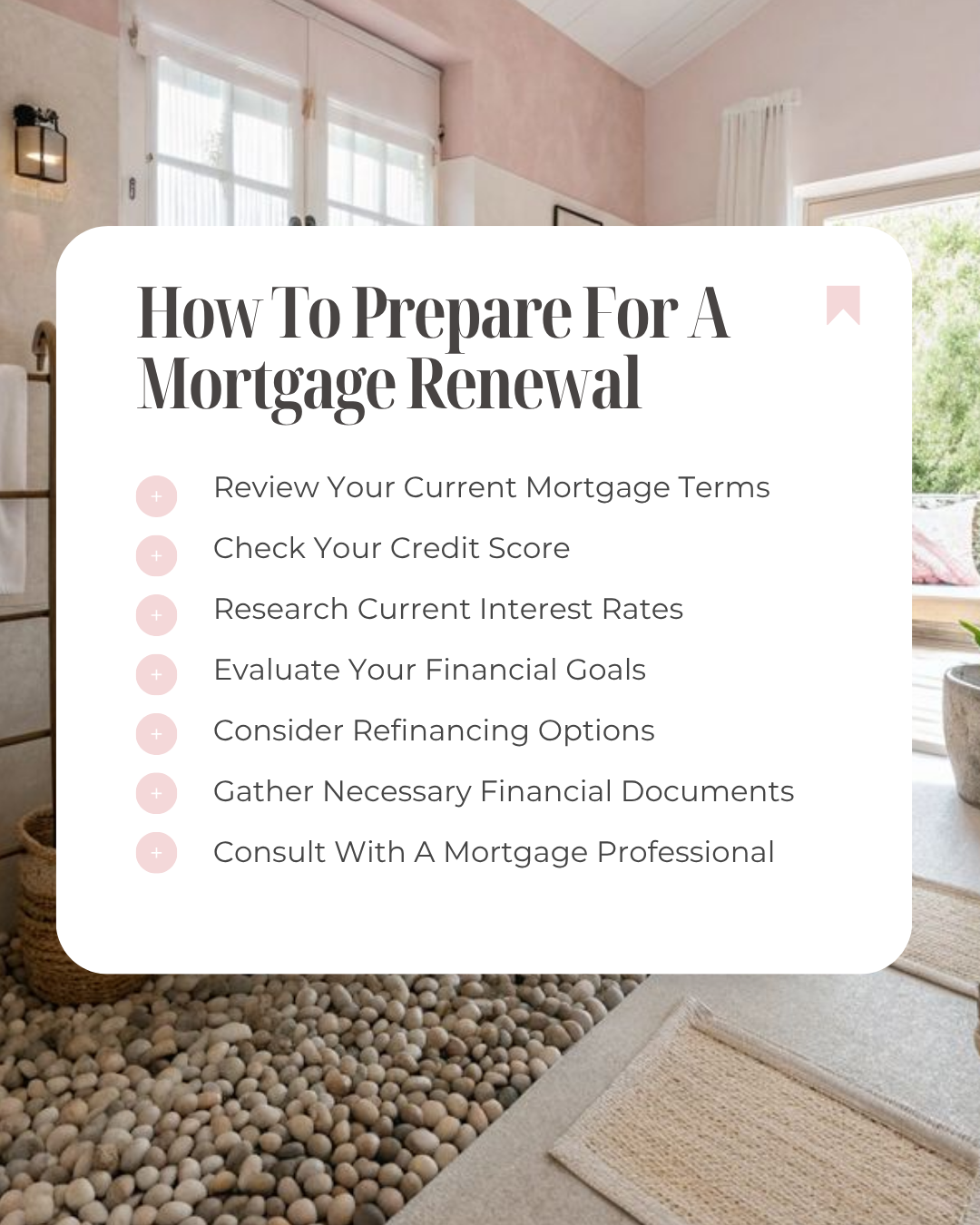

Preparing for a mortgage renewal means more than just signing on the dotted line—it’s about reviewing your options and planning for what’s next. Start by checking your current rate, exploring new lenders, and assessing your financial goals to make sure you get the best deal possible. Let’s work together to make your renewal a smooth step toward a stronger financial future! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

New to Canada and ready to buy a home? Start by understanding credit requirements, saving for a down payment, and exploring mortgage options tailored for newcomers. Let’s work together to make your homeownership dreams a reality here in Canada! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Back-to-school season is the perfect time to get your home organized and stress-free. Create designated spaces for backpacks, homework, and supplies to keep everything running smoothly. Let’s help you make your home a functional and welcoming space for your busy family! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Looking to enjoy your outdoor spaces before fall arrives? It’s the perfect time to freshen up your patio, add cozy lighting, and create a warm, inviting vibe for those crisp autumn evenings. Let’s explore simple ways to make the most of your backyard and soak up every last bit of the season’s beauty! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

2025 is the year to take control of your finances! Lowering your monthly debt obligations can free up cash flow and reduce stress. Whether it’s refinancing, consolidating, or adjusting your payment plans, let’s explore strategies that work best for your situation. I’m here to guide you every step of the way toward a healthier financial future! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

Thinking of selling an investment property? Understanding capital gains tax is key to planning your finances wisely. It’s the tax on the profit made from the sale, and knowing how it works can help you keep more of your earnings. Let’s break down the details so you can make informed decisions and maximize your investment returns! #CanadianMortgages #MortgageBrokersCA #HomeFinancingCanada #MortgageAdvice #FinancialFreedom #FirstTimeBuyer #CanadianBuyer #CreditHelp

Renewal season is around the corner—do you know why having a mortgage broker on your side matters? A broker helps you navigate your renewal options, compares rates from multiple lenders, and negotiates terms that fit your financial goals. I’m here to make sure you don’t just renew— you renew smartly and save. Let’s work together to get the best deal for your future! #CanadianBroker #CanadianAgent #HomeLoan #Investment #Finance #MortgageRate #CreditRepair #Refinance

New content drops every month

Easily download your favourite stories

01

Clicking the image to download

02

Right-click the image and select ‘save image’

03